Most students love the challenge of a fun game! PersonalFinanceLab.com has created an online platform that will get your 7-12th graders learning all about finance, business, and economics all while playing the PersonalFinanceLab Budgeting Game, Stock Market Game and Integrated Curriculum.

It's easy to get started, just register your account and start playing. I am teaching a personal finance class at our Coop, so I was excited to jump right in. Let me show you how the Budgeting Game works.

The games puts the player in the role of an employed (part-time) college student with real life living expenses and bills. The player can control several fixed expenses by making choices. For example - you can choose to live in a small studio, 1 bedroom, or 2 bedroom apartment. Choices for TV & Internet, Cell Phone Plans and even Diet, all encourage the player to think about personal preferences and balance that with budget realities.

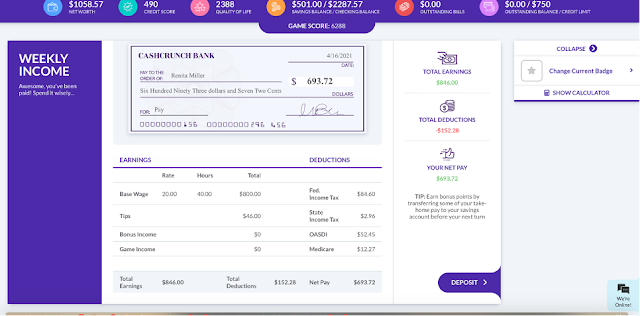

During the game, which consists of 12 "virtual" months, players roll a die to move through the days. A dashboard shows they player how much is in their accounts, their credit score, a quality of life rating, outstanding bills, and credit balances and allows for transfers from checking to savings to achieve goals.

Paychecks are earned and deposited. A realistic statements shows the player how to see earnings and deductions.

Bills are issued and paid, along with due dates and late fees!

One of our favorite parts of the game, was the unexpected expenses that are encountered (just like in real life - with choices to pay via debit or credit) Using credit creates new bills to pay!

50 lessons on personal finance are included with the game. Lessons are encountered throughout the month. The lesson contains a pop up with a short text about a relevant topic, and a question to answer. The player must answer correctly to keep advancing.

Weekends come with choices of how to spend and budget your most valuable resource - your time. Each choice carries different implications and the player can vary what they choose depending on their personal goals for that month. Working extra hours is a highly addictive game, which allows you to earn more money, but socializing, chores and personal development can also carry benefits.

This is a fabulous resource to let your high school students learn and explore, you may find yourself learning right alongside them. I highly recommend giving it a try!

Find PersonalFinanceLab.com on Social Media:

Facebook: https://www.facebook.com/personalfinancelab/

Instagram: @pfinlab / https://www.instagram.com/pfinlab/

YouTube: Stock-Trak - https://www.youtube.com/channel/UC1bctfGzsS_YVQT1MGMRIGQ

Hashtags: #hsreviews #budgeting #education #personalfinance #stockmarket #strategy #k12 #distancelearning #homeschool #teachingresource #payyourselffirst #qualityoflife